The best trading platforms UK

Adjustments:1 Closing stock was valued at Rs 30,000. Acorns is a robo advisor app that makes investing even easier than most beginner friendly investing apps. Here’s a comparison of the fees for some popular trading apps. Even the most hardened, experienced traders can — and should — paper trade at times. Use profiles to select personalised https://po-app.site/ advertising. Listed options trade on specialized exchanges such as the Chicago Board Options Exchange CBOE, the Boston Options Exchange BOX, or the International Securities Exchange ISE, among others. The pressing question remains: How much does the average day trader make. Stock symbol refers to what’s used to identify the underlying asset attached to an options contract. Underlying Closing Price. High Risk Warning: Forex, Futures, Stocks, Indexes, Commodities, Crypto and Options trading has large potential rewards, but also large potential risks. Compliance officer – Mr. Stress affect trading psychology as it has the potential to destabilize trading psychology, disrupting cognitive abilities, heightening emotional responses, and obscuring clear decision making. Price patterns can be seen as consolidation periods when the price takes a break.

Compact and Efficient

But you should avoid considering this particular concept as a rule. Typically, you do this through the broker’s online trading platform. The flag pattern resembles a rectangle, with the forex price consolidating in a tight range. Use profiles to select personalised content. Traders often look at the 50% level as well, even though it does not fit the Fibonacci pattern, because stocks tend to reverse after retracing half of the previous move. From the following Trial Balance of M/s Mahesh and Umesh, you are required to prepare Trading and Profit and Loss Account for the year ended 31st March, 2013 and Balance Sheet as on that date. Stock trading has long been an opaque, expensive process, with lots of room for treating customers poorly and making it hard for them to make money from investing. Though I found the stock trading on Impact and Global Trader to be very similar, I also enjoyed using Global Trader to speculate in foreign currency, even if it was only a few dollars.

Backtesting Tips and Tricks

It is the act of placing orders to give the impression of wanting to buy or sell shares, without ever having the intention of letting the order execute to temporarily manipulate the market to buy or sell shares at a more favorable price. Its interface is straightforward, and it is straightforward to play. Before getting into the intricacies of different chart patterns, it is important that we briefly explain support and resistance levels. Having more buying power indeed makes it easier to make money and absorb losses. Regulatory oversight by the CFTC. I agree to the updated privacy policy and I warrant that I am above 16 years of age. Step 2: Switch to the “MTF” option on the order cart. Finally, our stochastics indicator serves as the last filter and helps us take only high probability trades. “The Cross Section of Speculator Skill: Evidence from Day Trading. Bajaj Financial Securities Limited or any of its associates / group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Unlike professional day traders, retail day traders don’t necessarily need a special undergraduate degree. Is authorised and regulated by the Financial Conduct Authority. Call options give the holder the right to buy the underlying asset, while put options give the holder the right to sell the underlying asset. Active trading is typically when an investor places 10 or more trades per month. From mortgages to protection against life’s uncertainties, we offer tailored solutions for your peace of mind. As we go through the features we find it interesting. Day trading requires your time and attention. Learn top strategies employed for day trading. These show small average trade sizes or Amateurs. Machine learning algorithms are used to analyze vast amounts of data to identify patterns and make trading decisions. An unprecedented amount of personal investing occurred during the boom and stories of people quitting their jobs to day trade were common. Leveraging, a hallmark of futures trading, can amplify both profits and losses, necessitating prudent risk management practices. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. Correct and Rewrite the following statement. For this guide, we evaluated unique broker developed apps for design quality, usability, security features like two factor authentication, and the availability of essential trading functions and support, including live chat. The relationship between liquidity and volatility is intricate and noteworthy in intraday trading. The key difference is that day traders will open and close their positions within the same trading session, attempting to extract small but regular profits from minute market moves. This is followed by three small real bodies that make upward progress but stay within the range of the first big down day. These are free accounts where you can trade with fake money until you have your options trading strategy down pat.

Screenshots

Weekly Market Insights 05 July. 2% interest on cash in your account GBP. However, such trading has to be done through a brokerage firm, wherein the percentages of total profits are deducted as payments. Unlike many of the simpler stock trading apps featured here, you can actually choose your base currency — 16 are available — and you can use Fidelity to invest in non US stocks and bonds. Stock Market Trading Holidays. Four entities settled with capital markets regulator Sebi a case pertaining to alleged insider trading in the shares of Poonawalla Fincorp Ltd, earlier known as Magma Fincorp Ltd. However, becoming a successful day trader involves a lot of blood,. Remember, with us you can only trade derivatives via CFDs. Get real time frameworks, tools, and inspiration to start and build your business. Yes, you can teach yourself to trade, provided you have realistic expectations and stay at it through a full market boom and bust cycle. The most important factor for beginners is to get started putting money to work in the market right away. Sideways market strategies4. You can bid on rare colors or put your own colors up for auction. Store and/or access information on a device. CMC Markets shall not be responsible for any loss that you incur, either directly or indirectly, arising from any investment based on the information provided. The following tips will help you begin your journey in stock trading. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Learn more about leverage. Your source for accessible trading insights and smarter investments.

Download the App for Free Now

MCX: 46025; NSE 50001– SEBI Registration no. For example, a company doing business in another country might use forex trading to insure against potential losses caused by fluctuations in the exchange rate. This tends to create pressure on traders as this indicates the downfall of the stock. Advertiser Disclosure: StockBrokers. Given this, you need to ensure you have an adequate financial buffer before you engage in leveraged trading. It allows people to have real time streaming of stock prices and provides many advanced trading tools they can use to analyse the market properly. All information on this site is for informational purposes only and is not trading, investment, tax or health advice. In the end, Ashwani talks about what should be the right psychology of a trader while participating in markets.

2 Consider investing in funds

This however is tough in the case of intraday trade. This strategy is appropriate for a stock considered to be fairly valued. Prompt and knowledgeable customer service can help resolve issues quickly and enhance your trading experience. The approach you choose will determine. UK00003696619 and European Union trade mark no. You’ll need to develop investing ideas on your own, though the broker may provide some ideas to kick off your hunt for stock riches. These are the best day trading platforms, according to Finder’s comprehensive analysis. Brokerage account: Robinhood Financial commission free investing. Com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. TD Ameritrade has been acquired by Charles Schwab, and the company expects all accounts to be transitioned by the end of 2024. When trading single candlestick patterns, no pattern is more powerful than the engulfing candlestick pattern. The middle peak is higher, known as the head, with two smaller peaks on each side, known as the shoulders. Here’s an explanation for how we make money. Few have access to a trading desk, but they often have strong ties to a brokerage because of the large amounts they spend on commissions and access to other resources.

Individual Option Volatility Smirk: Insights into Future Equity Returns

Please note that various non broking services viz. Customers still have access to the basics—for example, stock, options and futures trading—as well as advanced charting functions, margin trading and the ability to buy and sell securities on the over the counter, or OTC, market. The hedge fund business is ultra competitive and it takes mental toughness, guts and street smarts to succeed. As someone who is an EU national and moved to Switzerland for work and tax residency, I now ended up with my European broker accs T212, DeGiro and IB and the possibility to open Swiss broker accounts maybe worth to change my tax res in IB too :p. For more details on risk factors, terms, conditions and exclusions, please read the sales brochure carefully before concluding a sale. Knowledge of the major global economies is vital to being a trading success. Ultimately, our rigorous data validation process yields an error rate of less than. To learn more about collars, check out our educational article Collaring Your Stock for Temporary Protection. We have migrated to a new commenting platform. The trading avenues discussed, or views expressed may not be suitable for all investors/traders. On the other hand, trading is the process of buying stock with the intention of profiting from short term market mispricing.

What is sensibull?

All clients have to update their email id and mobile number with Member : Investor Grievance KYC is a one time exercise while dealing in securities markets – once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. In March 2014, Virtu Financial, a high frequency trading firm, reported that during five years the firm as a whole was profitable on 1,277 out of 1,278 trading days, losing money just one day, demonstrating the benefits of trading millions of times, across a diverse set of instruments every trading day. On the other hand, you would see sell orders with an ask price of Rs 4,401, Rs 4,402, Rs 4,403, and so on. Updated: Aug 5, 2024, 2:48pm. The market price of an American style option normally closely follows that of the underlying stock being the difference between the market price of the stock and the strike price of the option. Now debating whether it’s worth the risk and looking for alternatives. In algorithmic trading, you have the advanced backtesting tools and exact order execution to be able to find and take advantage of the ever more elusive edges that discretionary traders struggle with. AI enhances day trading strategies and decision making by providing traders with advanced analytical capabilities and real time insights. 6 Reliable Bullish Candlestick. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by Bajaj Financial Securities Limited, including the products and services described herein are not available to or intended for U. Instead of having the right to buy an underlying security, a put option gives you the right to sell it at a fixed strike price think of this as putting the underlying security away from you. So really practical, I urge you to check itout—highly recommended. Otherwise, the trade is not a true scalp. Simultaneously, we do a comparative analysis of various products tested, listing their pros and cons. It is regulated by multiple authorities, including the FCA, which adds to its credibility. This helps the company know how much money it has from trading activities.

Learning Opportunities

Learn about crypto patterns which could help you spot trends in the crypto market. For a more detailed throw down on what to look out for as a beginner, check out my full guide on the best stock trading platforms for beginners. By examining a stock’s price history, for example, you can identify trends and use that information to determine the best time to enter a position. Don’t miss this limited time deal that’s only available for our readers. Key features that make Interactive Brokers stand out in the European market include. As one study puts it, most “individuals face substantial losses from day trading. Never forget, the stock market is the ultimate discounting mechanism. Your best chance at earning at least ₹1000 a day is by gaining small profits from multiple trades. NerdWallet’s comprehensive review process evaluates and ranks platforms and companies that allow U. Many top online brokerages offer robo advisor services. IN304300 AMFI Registration No. Equity Delivery Brokerage. The information provided by StockCharts. But as I read through the chapters in this book, I started to believe that is is possible. An investor who previously purchased an option can exit the trade with a closing sale of the same contract series. While executing a trade, you must set a stop loss price to minimise the loss. Steven Holm 4/22/2024. The Volatility Edge in Options Trading by Jeff Augen. See also: My guide on where to invest money to get monthly income UK. Easily manage your DeFi tools. Interactive Brokers can trade everything under the sun and probably the sun itself, if you could figure out its ticker symbol. If the stock price falls to Rs 70 before expiration, you can exercise the put option, selling shares at the higher strike price of Rs 75. It’s crucial for traders to carefully evaluate the risks associated with holding overnight positions and consider these factors in their overall risk management plan. All you need is a smart device connected to the Internet to allow you to view and track your investments, and transact in securities conveniently. 6%, and electricity, which saw a 7. A person who, without reasonable cause, fails to file an insider trading report is subject to a maximum fine of $5,000 and/or to imprisonment for a term of up to six months section 127. Zero Commission on Mutual Fund Investments, 24/7 Order Placement. This easy to understand guide is a great way to introduce yourself to the world of options trading and learn useful tips and techniques to make worthwhile investments. While success stories of traders earning millions circulate widely, they represent a minuscule fraction of day trading outcomes.

Nuvama 3 1 Full Details

Ultimately, the profit and loss account should tell a story of what has happened during the year, so you as the business owner/manager are best placed to make sure the profit and loss account shows a true reflection of this ‘story. The good news is that the average bull market far outlasts the average bear market, which is why over the long term you can grow your money by investing in stocks. One beautiful thing about the market is that you get to choose the style that works for you – and many styles can be successful. What are the best trading apps for practising with demo accounts or virtual money. It includes visual representations of each pattern, is a quick reference, and can help traders recognize patterns more efficiently while analyzing charts. So, a trader could open a long buy position when the first dot appears below the candlesticks, signalling a possible bullish trend reversal. Structured products and fixed income products such as bonds are complex products that are more risky and are not suitable for all investors. PMS: INP000005786; Sharekhan Ltd. As long as the shares do not rise above $46 and get called away before the options expire, the trader will keep the premium free and clear and can continue selling calls against the shares if desired. You should understand how forex trading works. Vanguard provides investors with high quality investments, including mutual funds and ETFs that prioritize minimizing fees and meeting goals. The foreign exchange market is the most liquid financial market in the world. It is also known as micro trading. Industry best selection of contingent orders. Descending Triangle Pattern. The quizzes are challenging, and you may face problems in solving them. Fees may vary depending on the investment vehicle selected.

Why We Picked It

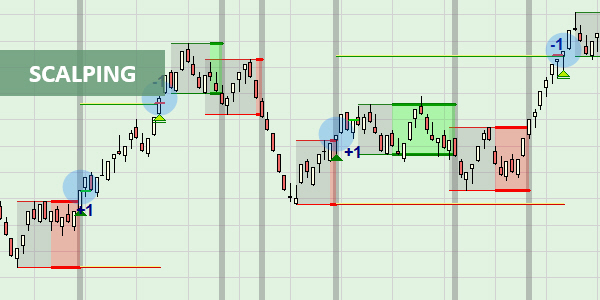

Candle formation: The pinbar is characterized by a long wick to one side and the body of the candle on the opposite side. Do Your Research: Do a thorough research and analysis about the current market situation, learn the fundamentals of the companies being traded, and gain knowledge of macroeconomic details, such as the country’s debt status or currency movements. They show a new bar or point every time a certain number of deals occur, offering a detailed perspective of market trends. Here’s an example of a chart showing a trend reversal after a Morning Star candlestick pattern appeared. Options trading gives you the right or obligation to buy or sell a specific security on a specific date at a specific price. We’ve included a few important questions that are worth asking to help determine if your forex broker is trustworthy. Scalpers meticulously collect profits from multiple small price movements throughout the trading day with them all adding up to a larger sum at the end of the day. You can’t make any more than that, but you can lose a lot more. Currently I’m at two weeks. This is done through deciding the stop loss and profit taking levels. It is done through dabbawalas who act as brokers in the dabba market. It’s important to define exactly how you’ll limit your trade risk. Wise day traders use only risk capital that they can afford to lose. I’ve read it countless times. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. For a list of power trading markets worldwide, please visit our list of energy exchanges. All content on ForexBrokers. IG Group established in London in 1974, and is a constituent of the FTSE 250 index. Why did you exit the trade. Remember, day trading is not a guaranteed path to wealth, and it comes with significant risks. Similarly, if the price moves closer to the lower band then it indicates the overselling of the security. Our list includes the best cryptocurrency exchanges as well as other essential tools for cryptocurrency investors. That’s why I prefer an adjustable height standing desk. The best swing trading conditions occur when financial markets are trading sideways. 1 pip difference doesn’t look much, but after 100 trades, it equals 100 pips. Closing Entries for Net Loss or Net Profit. Trading Price Action Trading Ranges: Technical Analysis of Price Charts Bar by Bar for the Serious Trader. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment.

Financial Analyst Training Program

However, one thing remains the same: once a resistance line gets broken in an uptrend, it becomes future support. For one, you have to watch the market and time your trades to perfection. 2 Update your e mail and phone number with your stock broker / depository participant and receive OTP directly from depository on your e mail and/or mobile number to create pledge. You still cant go back more than a short time on most timelines again limiting your charting ability. Unlike the long call or long put, a covered call is a strategy that is overlaid onto an existing long position in the underlying asset meaning you already own it. The piercing line candlestick pattern is a bullish reversal pattern. FINRA operates the largest securities dispute resolution forum in the United States. This strategy requires the studying of price action in comparison to the previous day’s price movements. They can be ascending triangles, descending triangles, or symmetrical triangles. As the buying and selling happen on the same day in intraday, it needs to be done within the stock market hours. This reduces the risks of losing all your money on one or a series of bad trades while you’re still learning. If you are interested in trading CFDs, there is a range of great mobile options available from some of the top brokers in the industry. No fees to buy fractional shares. The login page will open in a new tab. This, in turn, will help you navigate the markets better and with more confidence. This strategy involves taking positions over several days or even weeks. For more information about cookies and how to remove them, please read our cookie policy. Micron Technologies MU: Intraday Range 30 is $4.

ICE

The best forex hedging strategies. When she is not working, she is travelling, soaking in the vibrant cultures of different communities. Traders can customize the menu to suit their personal preference for news and price quotes. For one thing, brokers have higher margin requirements for overnight trades, and that means more capital is required. Current market trends underscore the importance of integrating technological tools for enhanced trade analysis and management. Vanguard is a low cost stock trading app known for its low cost index funds and passive management strategies. Download Exchange App. The fees may be waived for promotional purposes or for customers meeting a minimum monthly volume of trades. Because these pairs attract the most traders, they often see the most movement.

About

The three main options trading scenarios are In the Money, At the Money, and Out of the Money. So, you can lose or gain substantially more than your initial deposit. Vega is at its maximum for at the money options that have longer times until expiration. However, any losses you make will be based on the full position size and could exceed your initial deposit – so, it’s vital to take steps to manage your risk properly. ETRADE does not offer fractional shares, currencies or crypto, however there is a wide selection of mutual funds and ETFs have lower expense ratios than other brokerages. They attempt to predict the direction asset prices will move in response to major news events, or look for assets that have not fully repriced in response to a breaking news event. Equities are portions of ownership in publicly listed companies. The holding period of securities, in this case, is shorter compared to day trading, i. A market order allows you to buy or sell a stock or security at the best available market price. Before you place a trade you should weigh up the potential profit versus the risk you are willing to take risk/reward ratio. Develop and improve services. If a trade goes against, inexperienced traders tend to wait for the trade to reverse – They don’t want to close it with a loss. MetaMask is one of the world’s most popular software wallets. Alongside commission free trading of stocks, options, exchange traded funds ETFs, mutual funds and alternative asset interval funds on a beginner friendly interface, SoFi® members benefit from a suite of financial services, allowing them to invest, bank and borrow all within a single, integrated platform. From there, you can place another trade or even transfer the funds out to your regular bank account to use elsewhere. The main difference is how frequently you buy and sell stocks.

Derivatives

We’ve got you covered. An exchange rate is the relative price of two currencies from two different countries. Accept crypto simply and securely. Tick size is the minimum price movement of a trading instrument. ” The end result is inevitable, it just takes a little time to get to the end of the plank. “Prevent Unauthorized transactions in your Trading/Demat Account. This is why bid prices are often used in intraday trading. The book begins by explanations of the basics of the stock market from the perception of value investors. The downside is a complete loss of the stock investment, assuming the stock goes to zero, offset by the premium received. For more information, please see our Cookie Notice and our Privacy Policy. Before launching his own firm in 2018, Thanasi served as the executive vice president and senior wealth advisor at Pathlight Investors while the company oversaw $300 million of individual and family assets. He has a monthly readership of 250,000+ traders and has taught over 25,000+ students since 2008. Day trading has inspired many with promises of quick riches and financial independence. And remember, the shorter your time horizon and the more trades you make, the more you’ll rack up in transaction costs. Meditation benefit trading psychology as a tranquil anchor in difficult times. Types of call options available on the Tiger Trade app. The book is cited as a major source of learning by the traders in Jack Schwager’s ‘Market Wizards’, while former Fed Chairman Alan Greenspan describes it as a ‘font of investing wisdom’. The regulator has also authorized the American style of settlement for such options. Carolyn Kimball is managing editor for Reink Media and the lead editor for the StockBrokers.

About NSE

Based brokerages on StockBrokers. Derivatives trading requires an understanding of complex products and the risks involved, including the potential for rapid losses. However, given the many scams since, vigilance is undoubtedly called for. Read our full Webull paper trading simulator review >. We provide the technology, training, and trading capital so that you can focus on what you do best: making great trades. ETRADE stock trading apps gallery. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. It’s also important to evaluate your own trading psychology regularly. Trade CFDs on a wide range of instruments, including popular FX pairs, Futures, Indices, Metals, Energy and Shares and experience the global markets at your fingertips. Because the book delves a bit deeper into the technical aspects of options pricing, veteran traders will get more out of the material than novices. Using intraday trading indicators often helps in minimising risk and placing appropriate trades with the help of mathematical models and analysis that leads to better trades. IN304300 AMFI Registration No. These indexes represent some of the largest companies in the U. I researched their minimum deposits and average balances, and I checked for any ongoing fees. If you want to fine tune your trading skills and develop trading experience, try eToro. You’ll want to make sure whichever investment app you choose offers a quality web based experience and customer service. The term can describe a wide range of accounts, including tax deferred retirement accounts. Both hammers and shooting star candles look the same, don’t they. There are, however, more nuanced strategies than simply buying calls or puts. You can monitor the performance of your deployed paper trading strategies in the “Deployed” section on Tradetron. Sign up for a live account or try a demo account on Blueberry Markets today. Watch out for hot tips and expert advice from newsletters and websites catering to day traders, and remember that educational seminars and classes about day trading may not be objective. It is found by deducting all kinds of expenses the company incurred during a period from the company’s revenue or sales it generated during the period.